November 16, 2022

Partner Perspective: An Interview on Upcoming CPA Exam Changes and the Captive Insurance Industry

You are highly involved with the AICPA and NASBA. How did you begin your involvement with these organizations?

I have been fortunate enough to develop really strong relationships with my clients over the years, and some of them have become my mentors. I had a client who was a member of the Board of Accountancy for Vermont and involved with the National Association of State Boards of Accountancy (NASBA). Through her involvement, I was encouraged to get involved myself and that has developed into multiple opportunities for leadership roles within the organizations throughout my career.

As someone who has served on the AICPA Auditing Standards Board, can you speak to the board’s mission and the importance of having firm representation on the board?

The auditing standards board for the AICPA is charged with setting the audit and attest standards for the country. This board has 18 members with representation from all big firms and many midsize firms like Johnson Lambert. This board also allows partners from different firms an opportunity to connect on technical questions with people from their industries and gain perspective on how audits are performed.

It’s our job to partner with clients and be professionally skeptical; not to catch them doing something wrong, but to help them avoid roadblocks later on. I like to think of our work as a proactive magnifying glass that identifies issues and solutions for clients; rather than a hammer hitting issues after the fact.

You also served on the AICPA Academic & Career Awareness Student Recruitment Committee and are a current member of the Board of Examiners (BOE), what do these boards work to accomplish?

Through serving on both of these boards, most recently the Board of Examiners for the AICPA, I have worked to assist in developing and overseeing the CPA exam for the nation. Since I began serving on this board in May 2020, we had to work to make the exam even more agile. A lot of this has involved reacting to the pandemic, developing a strategy for a remote exam, and continuing to ensure that the four sections of the exam are fair for everyone in this time of change.

What changes are coming to the CPA exam? And why is it important to understand the new exam process? How is the CPA Evolution initiative transforming the CPA Exam model?

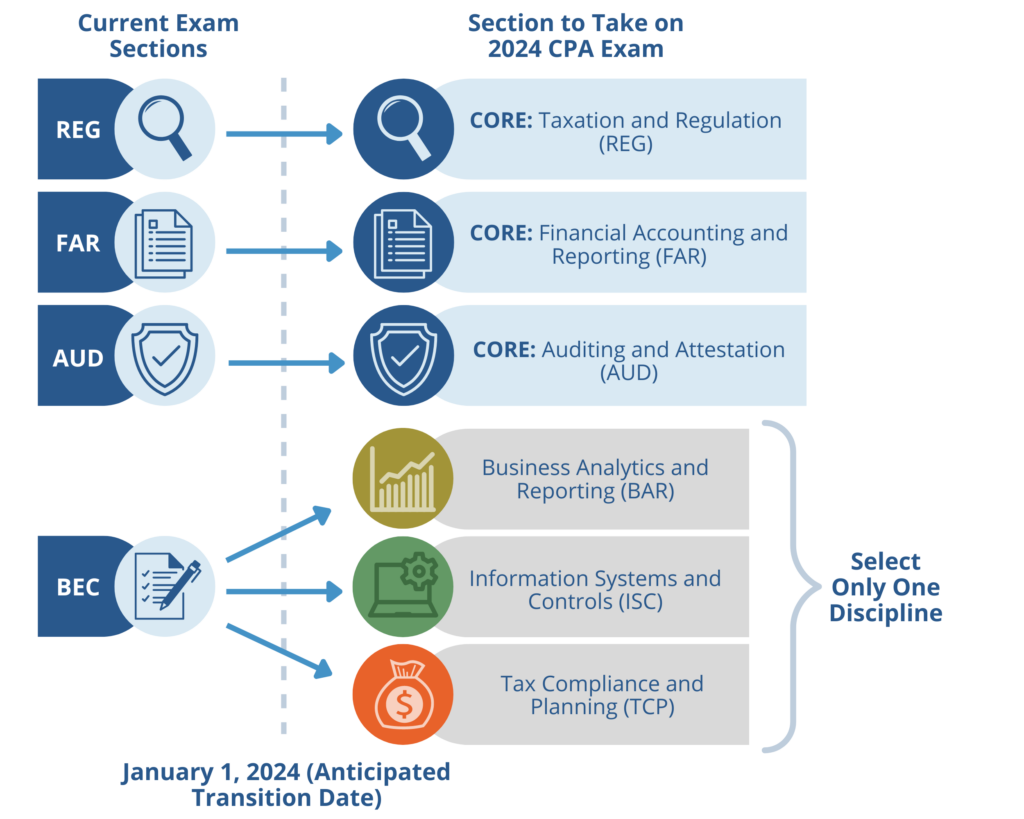

Beginning in 2024, with CPA Evolution the new CPA Exam model will be a Core + Discipline model. The model starts with testing the core of the practice through accounting, auditing, and tax, which all candidates will have to complete. Then, each candidate must choose a discipline section, to demonstrate greater skills and knowledge.

The new Disciplines reflect three areas of the CPA profession:

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

These changes are making the exam more palpable for someone who is already specialized in their career. Many professionals are finding themselves specializing much earlier on, like associates in our consulting practice, so for them these changes make the CPA exam that much more appealing and achievable.

CPA EXAM TIPS + IMPORTANT FACTS

- If you are currently pursuing the CPA exam, take the BEC section 1st, because BEC will satisfy one of the discipline sections in the new Core + Discipline model, in 2024.

- Candidates who have credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam.

- A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested.

- It is important to note that none of the sections of the current CPA Exam will be available for testing after December 15, 2023. There is a hard cutover from the current CPA Exam sections to the 2024 CPA Exam which will launch mid January 2024.

There is some uncertainty in terms of exam volumes for the new discipline sections that could lead to delays in score releases. Many state boards have approved credit extension policies to help minimize the impact of the transition. However, passing BEC before 2024 will help candidates minimize any impact.

What trends are you seeing in the captive space?

GROWTH

The biggest trend we are currently seeing in the captive space is growth. There is tremendous growth, and it has been a priority for leaders in the industry. Organizations like Captive Insurance Companies Association (CICA) and Vermont Captive Insurance Association (VCIA) have been working for the past 2-3 years to develop a succession plan, for the next generation, in order to maintain growth and demand. And just like any industry that’s experiencing high growth, that means there is high opportunity for incoming associates and new staff. The industry has never been more welcoming for new talent than it is today.

FLEXIBILITY

Another unique opportunity within the captive space is the ability to incorporate more remote employees into audit teams. Captive domiciles span the whole country and know no bounds in terms of geography, it’s also different than specializing on other audits, because each captive is unique serving the needs of their unique parent or sponsor organization. As such, the captive space is constantly evolving with new creative ways to use captives to address a market need.

OPPORTUNITY

Captives can present themselves in many different forms; they could be a group of CPAs, doctors, campgrounds, nonprofit organizations, and even technology companies like Apple and Facebook have captives. Our clients are the world’s top for profit and non-for profit entities that literally have products in all of our refrigerators, homes and offices, which is amazing. Our internal training offers multiple opportunities to learn more about captives and new staff are always with ourSenior Associates and Managers. Our staff are known in the industry as being leaders in technical expertise and for asking our clients insightful questions.

What do you do for fun outside of JL?

I love to spend time with my wife and two daughters. We recently got a puppy who loves to play and be outside, so much of our life revolves around her!