January 11, 2021

NAIC 2020 Highlights – Year In Review

Johnson Lambert LLP is dedicated to keeping you informed of changes adopted by the NAIC within the Statutory Accounting Principles (E) Working Group (SAPWG) that will impact your 2020 statutory basis financial statements and other significant NAIC activities related to group capital calculations, reinsurance, and an update on the activities of the Special Committee on Race and Insurance.

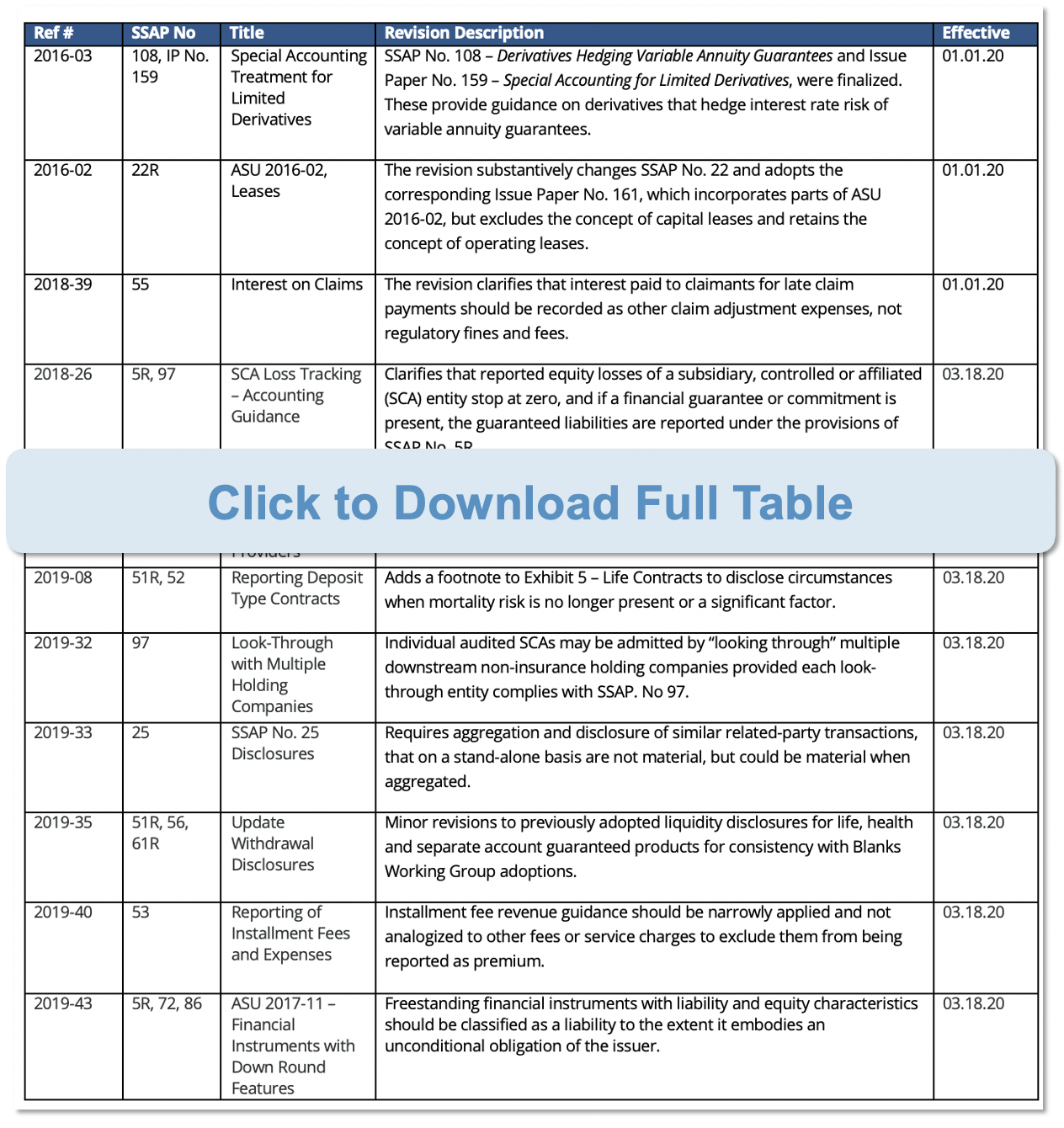

Statutory Accounting Updates

Rejected GAAP ASUs

The following FASB ASUs were rejected by the SAPWG during 2020:

- ASU 2015-10, Technical Corrections and Improvements

- ASU-2019-09, Financial Services – Insurance (Topic 944): Effective Date

- ASU 2020-01, Investments – Equity Securities (Topic 321), Investments – Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815), Clarifying the Interactions between Topic 321, Topic 323, and Topic 815

- ASU 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842), Effective Dates for Certain Entities

- ASU 2013-11, Income Taxes: Presentation of Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists

- ASU 2016-14, Not-for-Profit Entities: Presentation of Financial Statements of Not-For-Profit Entities

- ASU 2017-11, Earnings Per Share; Distinguishing Liabilities from Equity; Derivatives and Hedging: (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception

- ASU 2016-20 – Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers

- ASU 2017-14 – Amendments to SEC Paragraphs in Topic 220, Topic 605, and Topic 606

- ASU 2018-18 – Collaborative Arrangements (Topic 808): Clarifying the Interaction between Topic 808 and Topic 606

- ASU 2020-02 – Financial Instruments – Credit Losses (Topic 326) and Leases (Topic 842) – Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 119 and update to SEC Section on Effective Date Related to Accounting Standards Update No. 2016-02, Leases (Topic 842)

- ASU 2015-10, Technical Corrections and Improvements

- ASU-2019-09, Financial Services – Insurance (Topic 944): Effective Date

- ASU 2020-01, Investments – Equity Securities (Topic 321), Investments – Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815), Clarifying the Interactions between Topic 321, Topic 323, and Topic 815

- ASU 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842), Effective Dates for Certain Entities

Group Capital Calculation

On December 8, 2020, the Financial Condition (E) Committee unanimously adopted the Group Capital Calculation (GCC) template and instructions that were developed by the Group Capital Calculation (E) Working Group and adopted on November 17, 2020. The GCC template and instructions do not prescribe new regulatory standards for capital adequacy, but provide a tool for state insurance regulators to consistently evaluate group-wide capital for various insurance holding company systems with the goal to provide an “apples to apples” comparison. The GCC is intended to provide additional insights to Lead State Regulators and considers the financial condition of insurance and non-insurance entities in the holding company system. Lead State Regulators are expected to implement the GCC template as another tool for the annual group financial analysis procedures, review of Own Risk Solvency Assessment (ORSA) report filings, and in risk-focused coordinated financial examinations.

For more information, visit the NAIC website:

Reinsurance

As of December 2, 2020, 16 U.S. jurisdictions have adopted the 2019 revisions to the Credit for Reinsurance Model Law (#785) and 13 have actions under consideration. Three U.S. jurisdictions have adopted the 2019 revisions to the Credit for Reinsurance Model Regulation (#786) and five have actions under consideration. The revised Model Law and Regulation reduce collateral requirements for certain reinsurers in reciprocal jurisdictions and are necessary to implement the collateral and other provisions of the Bilateral Agreement Between the U.S. and the European Union on Prudential Measures Regarding Insurance and Reinsurance and the corresponding agreement between the U.S. and the United Kingdom (collectively, the Covered Agreements). The Model Law and Regulation were adopted as state accreditation standards and states have until September 1, 2022 to implement these revisions or face preemption by the Federal Insurance Office.

The Model Law and Regulation are prospective in nature and may only be used to reduce collateral after a reporting entity’s state of domicile adopts them. Additionally, the agreements must be new, amended, or renewed on or after the domiciliary state of the ceding company adopts the Model Law and Regulation.

Special Committee on Race and Insurance

The Special Committee on Race and Insurance established five workstreams to investigate diversity and inclusion in the insurance industry and provide direction to other Committees and Working Groups for future charges. The co-chairs of each workstream presented a brief update. Workstream One focuses on diversity and investigating racial barriers in the insurance industry. Workstream Two focuses on diversity and inclusion in State Insurance Departments and the NAIC. It is developing a survey to collect information and share best practices within the state insurance departments. The NAIC hired its first Diversity and Inclusion Officer. Workstreams Three, Four and Five focus on the unique aspects of diversity and inclusion in the P&C, Life, and Health insurance industries, respectively. The Special Committee and Workstreams will continue into 2021.

If you have any questions about this annual update you can contact us.