February 9, 2026

IRS Releases 2025 Loss Reserve Discount Factors

The Internal Revenue Service (IRS) issued Rev. Proc. 2026-13 on February 9, 2026, which contains the new property and casualty discount factors for the 2025 tax year. These factors were determined using the applicable interest rate of 3.57% for 2025 based on the composite method of Notice 88-100.

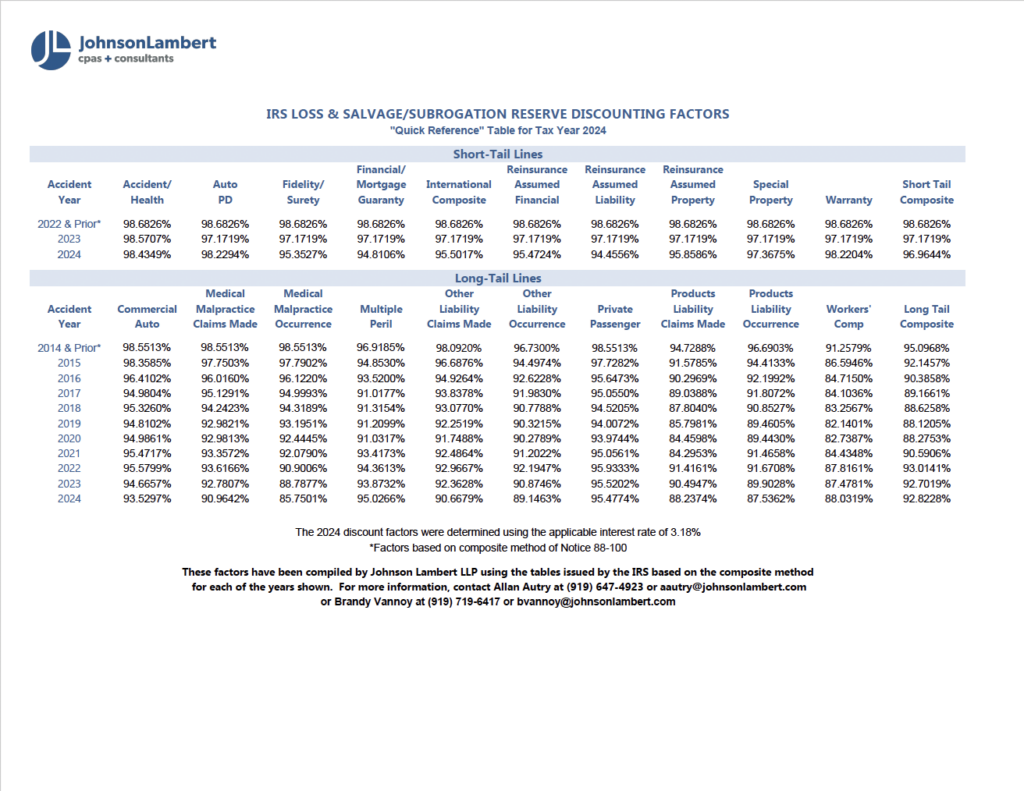

Linked in this article is a table that summarizes the new factors to use for computing discounted unpaid losses and estimated salvage and subrogation as prescribed for the 2025 tax year.